What is dwelling coverage & how much do you need?

Table of Content

This may influence which products we write about and where and how the product appears on a page. Amanda Jackson has expertise in personal finance, investing, and social services. She is a library professional, transcriptionist, editor, and fact-checker. The Author and/or The Motley Fool may have an interest in companies mentioned. “We all buy insurance not because of what we think is likely to happen but what might happen that could ruin our financial lives forever,” Thiderman says.

Take the square footage cost for your home, and add in the cost to replace your roof, cabinets, and attached appliances. This yields an approximate dollar amount for rebuilding your home, which is likely a different amount than you paid for it. This amount is the minimum amount of dwelling coverage you need to ensure you can rebuild your home in the event of a total loss. Buy or renew your policy to prevent any unnecessary damages to ensure you have adequate homeowners insurance coverage at all times. Your policy should also be adjusted as soon as possible when you make changes like home renovations or the purchase of a new home.

Average homeowners insurance costs

By contrast, full replacement cost is how much you would need to spend to actually replace the home in the event of a complete loss. Talk to your insurance agent about what is or isn’t covered by your policy so you can get additional coverage if necessary. Yes, a home insurance company may cancel your policy if your roof is old or in poor condition.

More expensive medical claims would be covered under liability insurance. This pays for minor injuries to others if they’re hurt on your property. This coverage is usually sold in small amounts, often between $1,000 and $5,000.

What does dwelling coverage not cover?

Most advise to choose an amount that’s around 20-30% of your Dwelling coverage. Also, take your lifestyle into consideration, as this covers what you’d usually spend on stuff like food, temporary storage of property, moving costs, etc. So let’s say you eat takeout everyday – breakfast, lunch, and dinner, you’ll most likely want to select an amount that’s more than someone who buys groceries and prepares their meals. While it’s tempting to look at the actual cash value of your home and assume that its market price right now will cover the cost to rebuild, don’t.

Make a separate inventory for these items, write down their estimated replacement costs, and ask your insurance agent if you need additional coverage for them. Homeowners insurance is a type of property insurance that safeguards your home and other valuable items. A standard policy covers damage and losses to your home and personal belongings. It also protects your assets from liability claims, such as personal injuries and pet-related incidents.

Find the Best Homeowners Insurance Companies Of 2022

It would pay for losses to these detached structures on the property. — Regardless of the cost to replace a home, an insurance company will only pay up to the covered amount stated in the policy. In some cases, the cost to replace a home will exceed the amount of insurance.

This is the reason your agent is going to ask a ton of questions. We don't want you being left short-changed if your home needs to be rebuilt and you want to have your home look as much like your previous home as possible regarding finishings. Manufactured home insurance in the U.S. generally ranges from $500 to $1,100 per year, according to American Modern Insurance Group, a prominent mobile home insurer. Many or all of the products featured here are from our partners who compensate us.

The coverage kicks in if your belongings are destroyed, stolen, or vandalized. According to Insurance.com, if you have a mortgage, your lender will require a minimum amount of dwelling and liability coverage. That coverage protects your investment—as well as your lender’s. Standard policies don’t cover everything, so you may need additional coverage to protect against perils such as floods and other natural disasters. — Replacement cost refers to the amount of money it will take to rebuild your home as it is.

Coverage is usually available as a separate policy or as an endorsement. Homeowners should carefully consider how much dwelling insurance they need. Once they have determined the amount of coverage, it's time to shop around for insurance quotes. Dwelling coverage is often not sufficient to fully protect a homeowner.

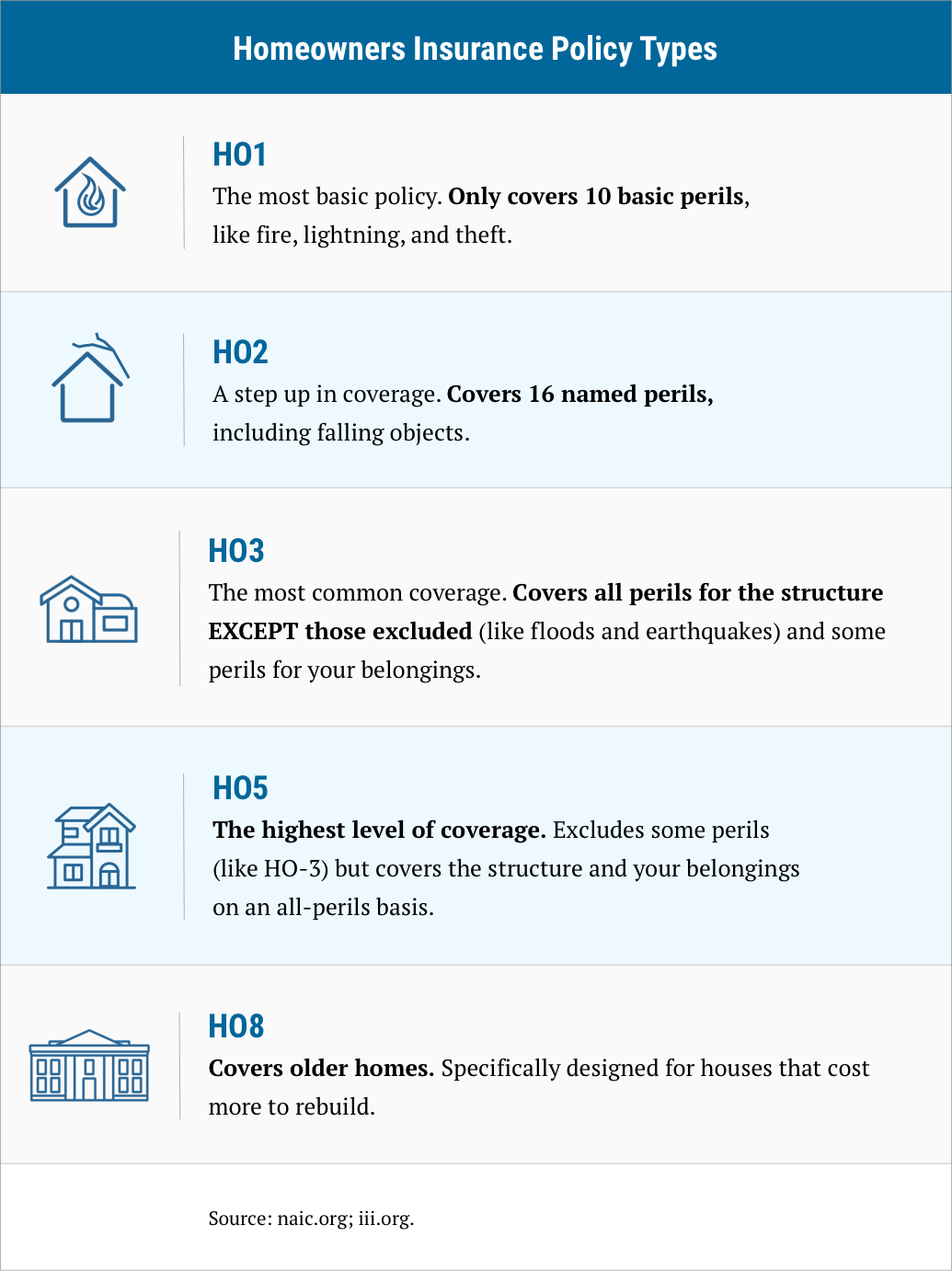

You might also want to adjust the material you use (e.g., choose more eco-conscious materials). Fortunately, you have a couple of options for increasing your dwelling coverage policy limit. The specific dwelling insurance coverage protection offered by your policy depends on the type of policy you choose. Even with an HO-1 policy, though, you can rest easy knowing that you’re protected against fires, theft, vandalism, civil unrest and a car driving into your living room. Dwelling coverage is just one section of a homeowners, condo or manufactured home policy. The average cost of homeowners insurance in the U.S. is $1,784 per year, according to a 2022 NerdWallet rate analysis.

O’Keefe says a licensed insurance agent can help advise you on whether extended dwelling coverage is right for your specific situation. “Extended dwelling coverage is designed to give wiggle room from the replacement cost coverage listed on your policy,” O’Keefe says. To calculate how much dwelling coverage you need, you first need to know how much it costs to rebuild.

Comments

Post a Comment